Application for extension of time for giving notice under section 143 of the Act. Meanwhile non-resident individuals file the M form.

Editable Annual General Meeting Agenda Template 8 Free Templates In Annual Board Meeting Age Meeting Agenda Agenda Template Meeting Agenda Template

Malaysian Listed Companies offers a roadmap of common content in annual reports.

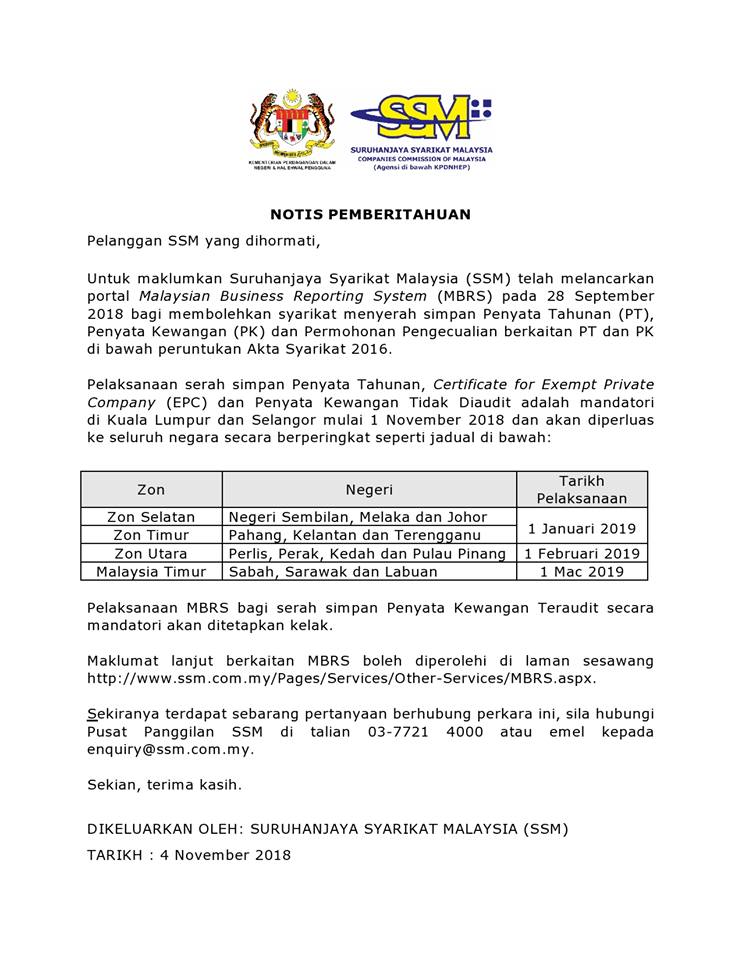

. Upon registration of his firm with the Institute lodge an annual return with the Institute by 31 January of each calendar year despite. The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia SSM within one month or in the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia within two months after the annual general meeting. The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia SSM within one month after holding its AGM or in the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia within two months after the annual general meeting.

It is due within 30 days from the anniversary of its registration incorporation date in Malaysia. The tax return is deemed to be a notice of assessment and is. The submission is done based on the Calendar Year not the Financial Year End.

Type Title File Size. This includes Exempt Private Companies. Announcements and Information.

These factors mean that reading interpreting and understanding annual reports need financial knowledge and expertise. Annual return of the HAPPY FAMILY SDN. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

What is Annual Return. The information contained on this. From 11 Sep 2016 to 25 Jul 2022.

A Guide to Understanding Annual Reports. Last modified 28 Jun 2022 Director. All these particulars are to be submitted on the yearly basis within thirty 30 days of the anniversary date for the local.

Further notification to submit the Annual Return AR report. Where a holding company has a subsidiary company incorporated in a country outside Malaysia whether the subsidiary company has or has not established a place of business in Malaysia there shall be annexed to the balance-sheet and profit and. Made up to the 19th day of November 2011 being the.

IGB Commercial REIT was listed in September 2021 while Sunway REITs latest financial year consisted of an 18-month period ended 31 December 2022. 2 The requirement under subsection 1 is not applicable to a company in the calendar year which it is incorporated. A private company b public company 15000.

The Malaysia 10 Years Government Bond reached a maximum yield of 4524 18 May 2022 and a minimum yield of 25 6 August 2020. In the case of a company keeping pursuant to its articles a branch register in any place outside Malaysia the lodgement of annual return must be made within two months after the. Lodgement of annual return under section 68 of the Act.

Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. Application to the Minister for exemption from application of Subdivision 9 under section 153 of the Act. It is due within 30 days from the anniversary of its registration incorporation date in Malaysia.

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia SSM within one month from the date its AGM held. Their DPUs shown in table above were annualised figures for the period between January and December 2021. Annual Return comprise of all companys information such as the business activities the location of the business registered office particulars of its director s companies secretary ies and members with its shareholding particulars in the company.

Submission of the annual return to the Institute is MANDATORY as stated in B2009 1 d and 2 of the Institutes By-laws On Professional Ethics Conduct and Practice which reads as follows. In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you are filing. Malaysian REIT Data LIVE Daily Updates.

3 The annual return of a company shall contain the. Companies must submit to the SSM an Annual Return AR for each calendar year. As stated in the Companies Act 2016 the Annual Return of a company must be submitted on each anniversary of the date of the company and not more than 30 days from that date.

Annual return and financial statement of a private limited company are filed annually to the Companies Commission of Malaysia. Annual Return is a. Every member in public practice is required to -.

DUTY TO LODGE ANNUAL RETURN. Companies must submit to the SSM an Annual Return AR for each calendar year. The Annual Return is an important document that must be sent to SSM as prescribed.

Resident individuals who do not carry on a business will file the BE form whereas resident individuals who do carry on a business will file the B form. This will assist in deciphering the content and structure of annual reports to guide decision making. The annual return that is signed by a director manager secretary of the company should be lodged with Companies Commission of Malaysia SSM within 30 days after its Annual General Meeting AGM in accordance with the Company Act 2016.

All local companies Section 68 and foreign companies Section 576 registered within SSM must lodge Annual Return AR. Annual Returns for companies with an Anniversary Date in 2017 only need to be made in 2018 as the. 1 A company shall lodge with the Registrar an annual return for each calendar year not later than thirty days from the anniversary of its incorporation date.

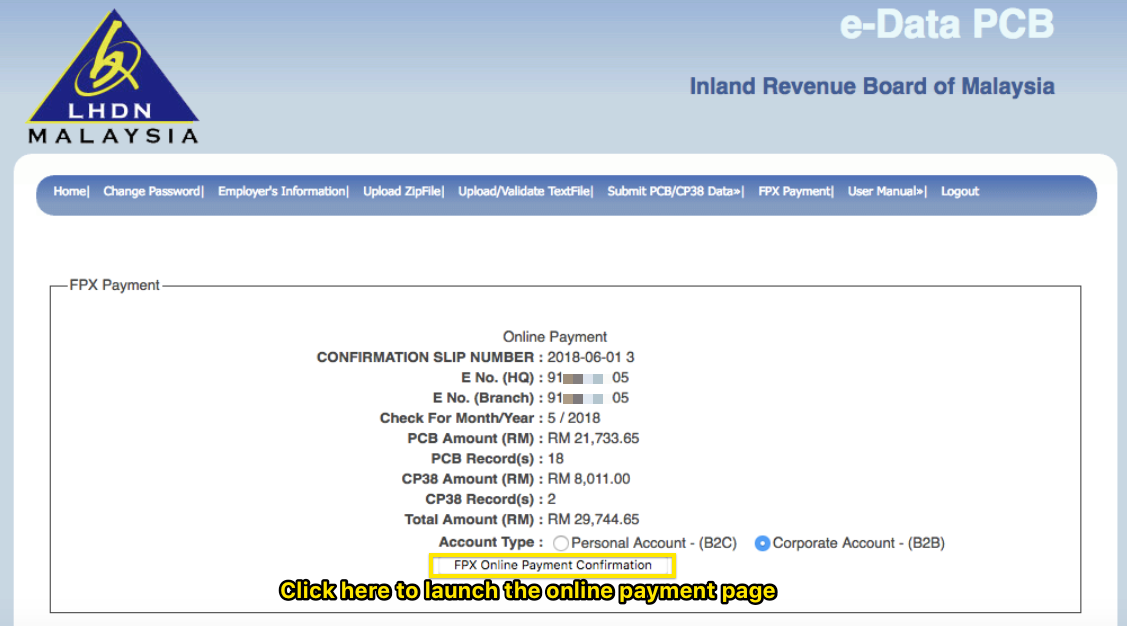

Business Income Tax Malaysia Deadlines For 2021

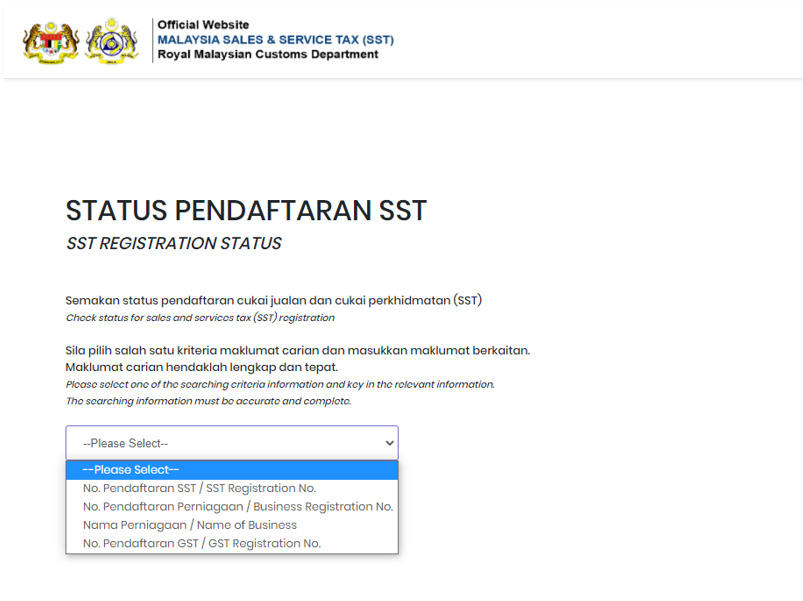

Malaysia Sst Sales And Service Tax A Complete Guide

Individual Income Tax In Malaysia For Expatriates

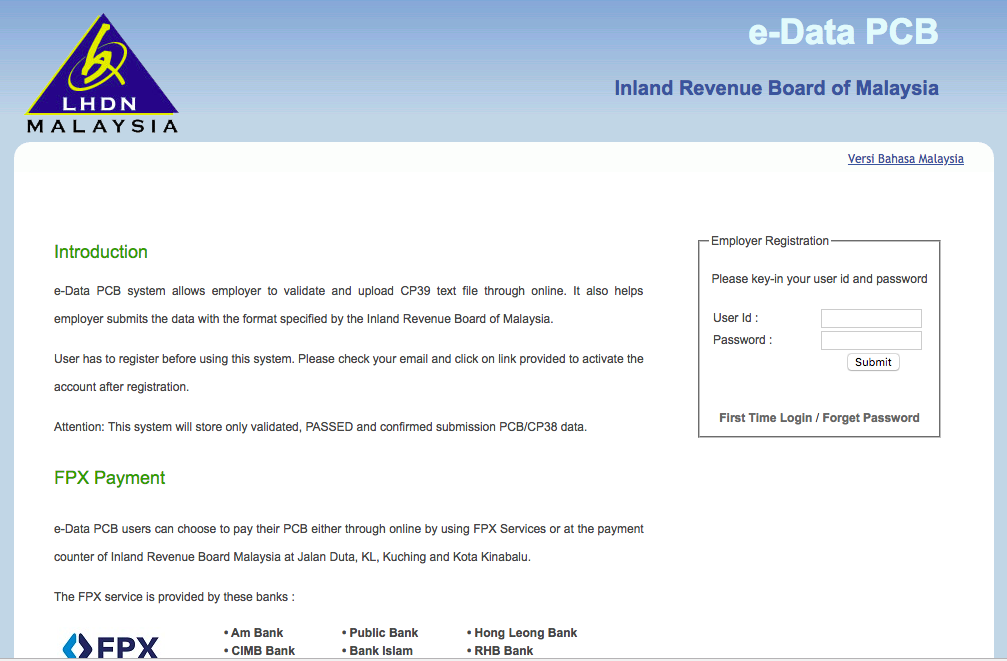

Everything You Need To Know About Running Payroll In Malaysia

Accounting Malaysia Importance Of Well Structured Financial Statement By Beyondcorporategroup Com Accounting Financial Statement Accounting Services

8 Types Of Business Entities To Register In Malaysia Foundingbird

Business Income Tax Malaysia Deadlines For 2021

Malaysia Sst Sales And Service Tax A Complete Guide

8 Key Updates Of The Companies Act 2016 For Smes In Malaysia Foundingbird

How To File Your Taxes For The First Time

Everything You Need To Know About Running Payroll In Malaysia

Khazanah Nasional Khazanah My Twitter

Business Income Tax Malaysia Deadlines For 2021

Business Income Tax Malaysia Deadlines For 2021